The crypto market is a dynamic and volatile space, presenting traders with countless opportunities to earn profits. However, navigating this unpredictable market requires a solid trading strategy. In this guide, we will delve deep into five proven crypto trading strategies that cater to traders of all levels. By the end, you’ll have actionable insights to elevate your crypto trading game.

1. Day Trading: Capturing Intraday Opportunities

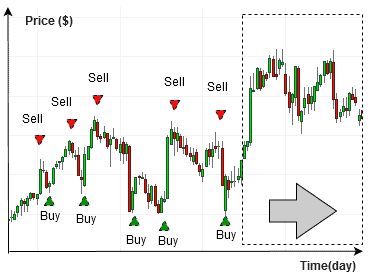

Day trading is one of the most popular strategies among active traders. It involves buying and selling cryptocurrencies within the same day to capitalize on short-term price fluctuations. The goal is to avoid holding any positions overnight to reduce exposure to risks from sudden market changes.

How Day Trading Works

Day traders rely heavily on technical analysis. They study candlestick patterns, volume indicators, and moving averages to identify potential trade setups. They focus on liquid cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or Binance Coin (BNB) to ensure easy entry and exit.

Steps to Start Day Trading

- Choose the Right Exchange:

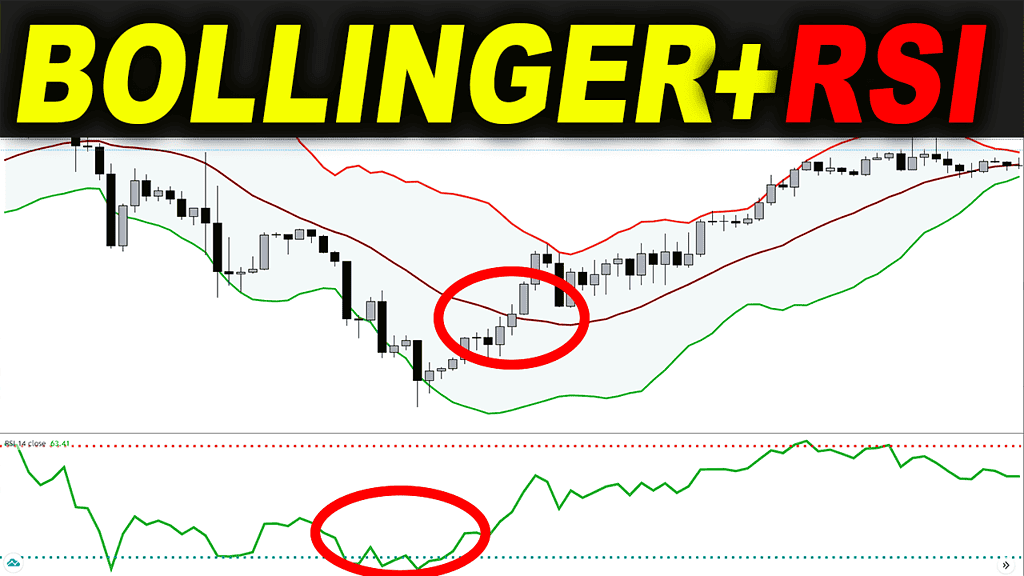

Platforms like Binance, Coinbase Pro, and Kraken offer advanced charting tools and real-time trading features. - Set Up Your Tools:

Use trading platforms like TradingView for technical analysis. Focus on indicators like Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands. - Establish Risk Management Rules:

Never risk more than 1–2% of your portfolio on a single trade. Use stop-loss orders to limit potential losses. - Monitor Market News:

Be aware of news events or market updates that could influence prices.

Advantages of Day Trading

- High profit potential from short-term price movements.

- No overnight risk exposure.

- Opportunities available daily.

Challenges

- Requires constant monitoring and quick decision-making.

- High fees for frequent trades can eat into profits.

2. Swing Trading: Riding the Market Waves

Swing trading is a medium-term strategy where traders hold positions for several days to weeks. Unlike day trading, it doesn’t require constant monitoring, making it ideal for those who can’t dedicate full-time attention to the markets.

How Swing Trading Works

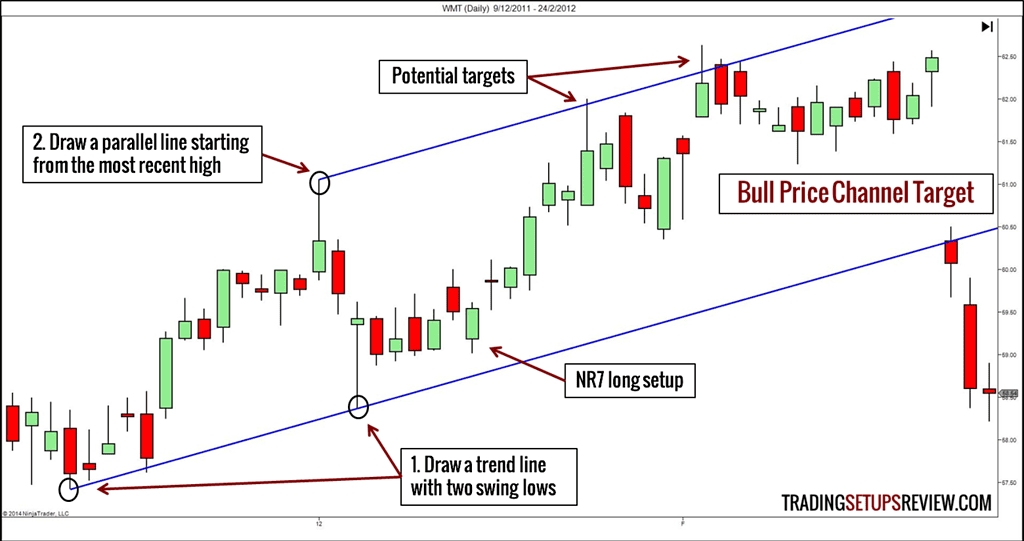

Swing traders aim to capture price “swings” between support and resistance levels. They use both technical and fundamental analysis to predict price movements.

Steps to Execute Swing Trading

- Identify Trends:

Use tools like Moving Average Convergence Divergence (MACD) and Fibonacci retracement to spot trends and reversal points. - Set Realistic Targets:

Define entry, stop-loss, and take-profit levels before placing a trade. - Track Key Events:

Keep an eye on market news, regulatory updates, and token-specific developments.

Advantages of Swing Trading

- Less stressful compared to day trading.

- Works well for traders with limited time.

- Fewer trades mean lower transaction costs.

Challenges

- Overnight risks due to market gaps.

- Requires patience and discipline to wait for trade setups.

3. Scalping: Profiting from Small Moves

Scalping is a high-frequency trading strategy focused on making small profits from minor price changes. Scalpers execute dozens or even hundreds of trades daily, aiming to accumulate substantial gains over time.

How Scalping Works

Scalpers trade on short time frames, such as 1-minute or 5-minute charts. They target cryptocurrencies with high liquidity and low spreads to minimize slippage.

Steps to Start Scalping

- Choose High-Liquidity Pairs:

Pairs like BTC/USDT or ETH/USDT are ideal due to tight spreads. - Use Leverage Cautiously:

Leverage amplifies both profits and losses, so use it responsibly. - Automate with Bots:

Scalping requires precision and speed. Consider using trading bots for executing trades. - Limit Emotions:

Stick to your plan and avoid chasing losses.

Advantages of Scalping

- Quick returns in active markets.

- Suitable for traders who thrive on fast-paced action.

- Lower risk exposure since positions are held briefly.

Challenges

- High transaction costs due to frequent trading.

- Demands intense focus and quick decision-making.

4. HODLing: Long-Term Wealth Creation

HODLing, derived from a misspelling of “hold,” refers to buying cryptocurrencies and holding them long-term, regardless of market volatility. This strategy is based on the belief that the value of strong cryptocurrencies will appreciate over time.

How HODLing Works

HODLers focus on cryptocurrencies with solid fundamentals and long-term growth potential. They ignore short-term market fluctuations and maintain their investments through market cycles.

Steps to Start HODLing

- Choose the Right Coins:

Invest in well-established coins like Bitcoin, Ethereum, or projects with real-world utility. - Secure Your Assets:

Store your holdings in hardware wallets like Ledger or Trezor for maximum security. - Stay Informed:

Keep up with industry developments to ensure your investment remains relevant.

Advantages of HODLing

- Low-stress strategy requiring minimal effort.

- Lower transaction fees due to infrequent trading.

- Historically, long-term holders of Bitcoin and Ethereum have seen substantial gains.

Challenges

- Requires patience and mental resilience during market downturns.

- Risk of losing out on shorter-term opportunities.

5. Arbitrage Trading: Exploiting Price Gaps

Arbitrage trading involves buying a cryptocurrency on one exchange and selling it on another where the price is higher. This strategy leverages price discrepancies between exchanges.

How Arbitrage Works

Cryptocurrency prices vary slightly across exchanges due to liquidity differences, trading volumes, and regional demand. Arbitrageurs capitalize on these variations to earn profits.

Steps to Start Arbitrage

- Monitor Prices:

Use platforms like CoinMarketCap or CryptoCompare to identify price differences. - Select Compatible Exchanges:

Choose exchanges with low transaction fees and fast withdrawal options. - Act Quickly:

Price discrepancies are short-lived, so speed is crucial. - Account for Fees:

Ensure transaction and withdrawal fees don’t negate your profits.

Advantages of Arbitrage Trading

- Low-risk strategy when executed correctly.

- Profitable in both bullish and bearish markets.

Challenges

- Requires quick execution to capitalize on price gaps.

- Transaction fees and delays can reduce profitability.

Bonus Tips for All Strategies

- Diversify Your Portfolio: Avoid putting all your funds into one strategy or cryptocurrency.

- Keep Learning: The crypto market evolves rapidly. Stay updated on the latest tools, trends, and strategies.

- Practice Discipline: Emotional trading often leads to losses. Stick to your plan and risk management rules.

Crypto trading is not a one-size-fits-all endeavor. Whether you prefer the adrenaline rush of scalping or the patience of HODLing, the key is to choose a strategy that aligns with your goals and risk tolerance. Start small, learn from your experiences, and adapt as you gain confidence. With these five strategies, you’re well-equipped to navigate the exciting world of crypto trading.

Join our Telegram community to receive real-time crypto signals and tips from experts. Stay ahead of the market with cryptosignalstelegram.com!